Your Medical Benefits

Affordable, quality care for you and your family

Benefit Summary

The Essential Worker Healthcare Trust’s health plan options have been designed to provide the care you and your family need with:

- Lower monthly premium payment for employee and dependent coverage

- Free preventive care, like regular checkups

- Free generic drugs

- Lower deductibles and other out-of-pocket costs

Most workers can choose between 2 health plans

Many long-term care workers will have a choice of 2 health plans: an Exclusive Provider Organization (EPO) through Kaiser Permanente or a Preferred Provider Organization (PPO) through the Regence network. If you choose Kaiser Permanente, you must use Kaiser Permanente healthcare providers for your services to be covered.

If you live outside the Kaiser Permanente service area, or choose not to enroll in Kaiser Permanente, you can enroll in coverage through the Regence PPO. For your services to be fully covered at the maximum benefit level with the Regence PPO, you must use healthcare providers in the Regence network.

Benefits

Download the Essential Worker Healthcare Trust Benefits Guide in: English, Español, Tagalog, русский язык, Tiếng Việt.

Eligibility

Find out if you’re eligible for coverage through EWHT.

Plans at a Glance

Both plans cover the same kinds of services, with the same costs to you when you need care—but how they work is different.

You can view our Terms to Know to learn more about the language used to describe these plans.

Compare 2026 Benefit Costs

| Regence PPO In-network providers* |

Kaiser Permanente EPO In-network providers* |

|

|---|---|---|

| Annual deductible | $800 individual/$1,600 family | $800 individual/$1,600 family |

| Annual max out-of-pocket | $2,000 individual/$4,000 family | $2,000 individual/$4,000 family |

| Preventive care | You pay $0 | You pay $0 |

| Primary care and behavioral health office visit | You pay $5 for the first 3 outpatient visits (in any combination). Additional visits are $20 each. | You pay $5 for the first 3 outpatient visits (in any combination). Additional visits are $20 each. |

| Specialist, physical therapy | You pay $40 per visit | You pay $40 per visit. Physical therapy is limited to 40 visits per year. |

| Urgent care | You pay $60 per visit | You pay $60 per visit |

| Emergency room | You pay $160 (waived if admitted to the hospital) then 20%, after you meet the deductible | You pay 20% after you meet the deductible |

| Lab tests and X-rays | You pay 20% | You pay 20% after |

| Chiropractic, spinal manipulations | You pay 40 per visit ** | You pay 40 per visit limited to 20 visits per year |

| Acupuncture, massage therapy | You pay 40 per visit ** | You pay 40 per visit limited to 12 visits per year |

| Most other services (such as imaging, surgery, hospital stays, etc.) | You pay 20% after you meet the deductible | You pay 20% after you meet the deductible |

* For more details on the plans, visit More Plan Information to view both Regence and Kaiser’s Summary of Benefits and Coverage (SBC). Regence’s SBC will show you your costs for seeing out-of-network providers.

**For Regence, in-network acupuncture, spinal manipulation, and massage therapy services are limited to 36 combined visits per year.

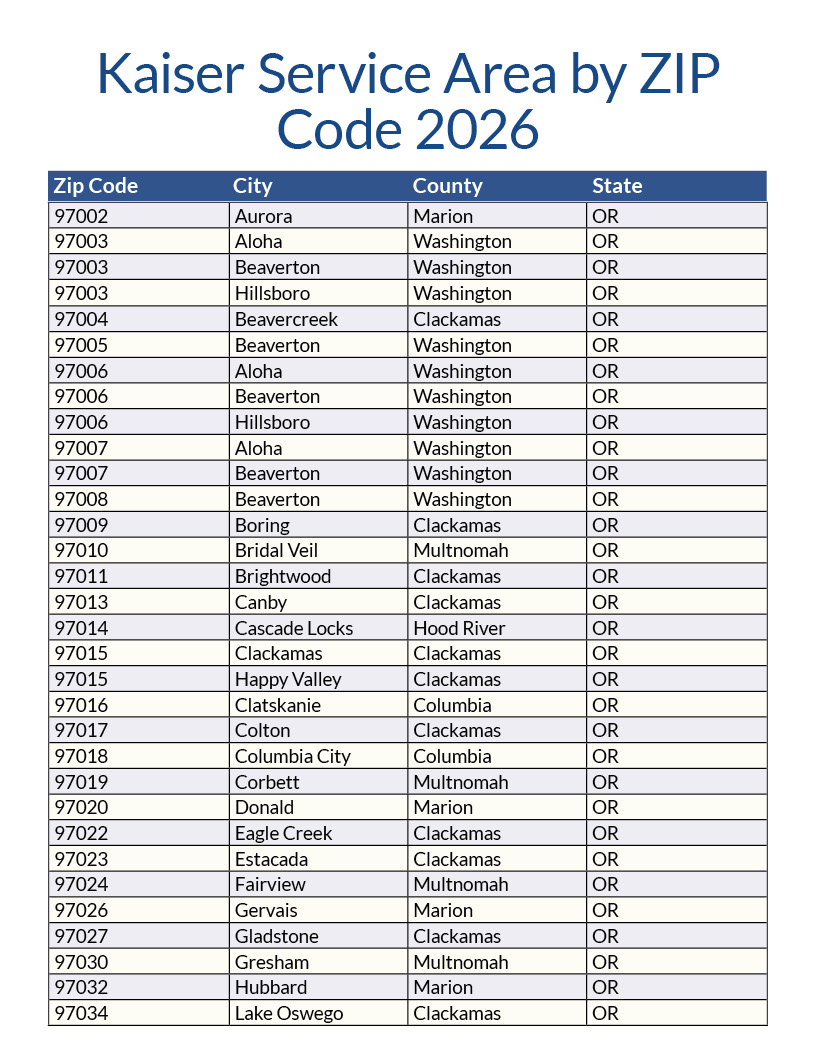

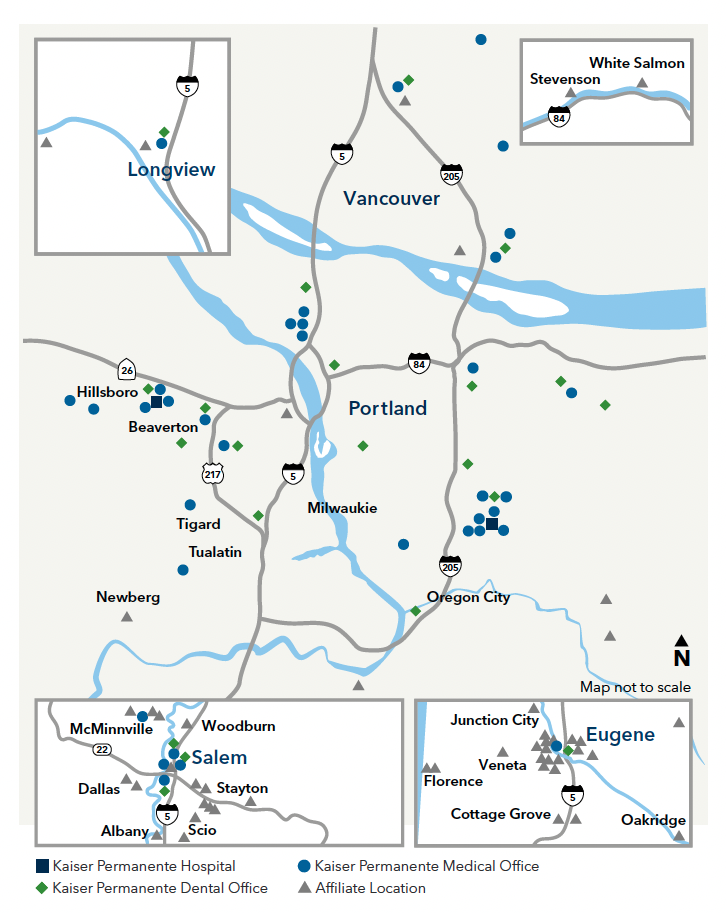

Kaiser Permanente Service Area

Contact Information

Essential Worker Healthcare Trust Office

(833) 389-0027

Reasons to contact the Trust office:

- Customer Service/Eligibility/Enrollment

- Questions about your claims

Regence PPO

(866) 240-9580

Reasons to contact Regence PPO:

- Find a care provider

- Schedule an appointment

- Questions about switching from another plan

- Questions about your ID cards

- Replace lost ID cards

OptumRx, Inc.

(844) 368-0083

Reasons to contact OptumRx:

- Find a pharmacy near you

- What drugs are covered under your plan

- How to enroll in maintenance drugs

Kaiser Permanente EPO

1-800-813-2000

Reasons to contact Kaiser Permanente:

- Find a care provider

- Schedule an appointment

- Questions about switching from another plan

- Questions about your ID cards

- Replace lost ID cards